The Rise of Fintech-as-a-Service: Why Banks Are Becoming Platforms

Banks used to be closed systems: deposit, lend, reconcile, repeat. Today many of those same institutions are quietly turning into platforms — not because they suddenly love developer conferences, but because customers want seamless financial experiences and competitors are building them faster.

That shift matters to ordinary people because it lowers friction where money meets life. A small business owner can add card acceptance to an invoicing app in days instead of months. A mobile app can offer instant microloans or an embedded savings account without becoming a bank overnight. Even services like Online credit repair help are part of the ecosystem — consumers who improve their credit through digital tools become more eligible for embedded financial offers, and the whole system benefits from better data and smoother flows.

“Banks are no longer just places where money sits — they’re toolkits that other companies use to create financial experiences.”

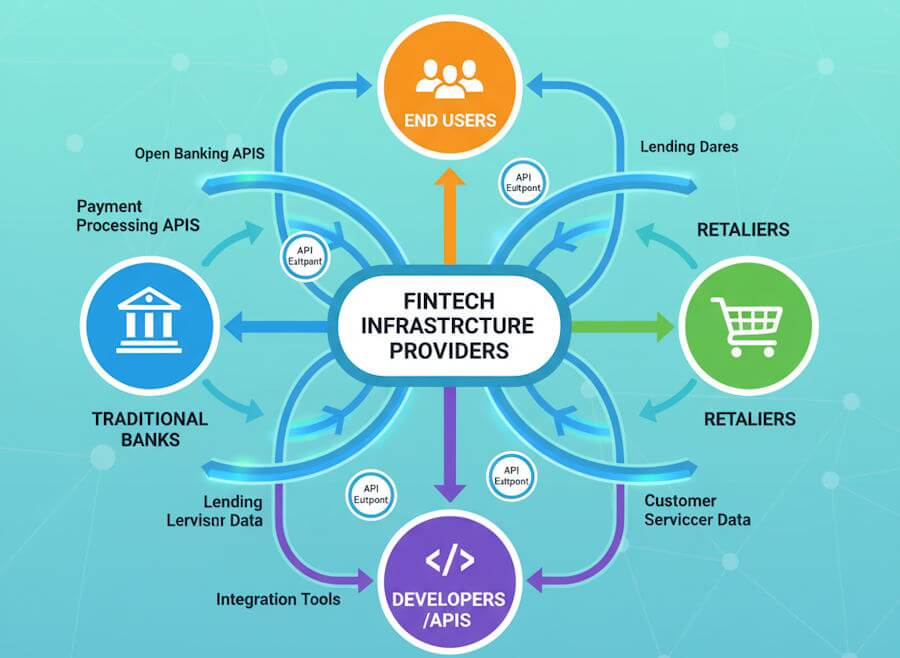

At its heart, FaaS rearranges two things: who builds financial services and where those services live. Previously the bank built & owned the whole stack. Now specialist infrastructure providers build the stack, banks (or regulated partners) provide the legal plumbing, and non-financial brands integrate the experience. The result is a marketplace in which banking capabilities are offered as products — flexible, scalable, and often white-labeled.

Why banks are embracing the platform model

There are practical and strategic reasons. Practically, banks want to monetize dormant capabilities (like settlement systems or compliance teams) and diversify revenue beyond net interest margins. Strategically, being a platform keeps them central to customer relationships even when the customer interacts through a third-party app. Instead of losing relevance, banks can be the invisible engine behind many customer journeys.

| Stakeholder | Benefit | Typical Use Case |

|---|---|---|

| Banks | New revenue streams; lower cost per client | API access to deposits, KYC, and compliance for partners |

| Fintech providers | Faster time-to-market; reduced capital burden | Card issuance, embedded lending, or payments-as-a-service |

| Non-financial brands | Better customer engagement; increased loyalty | Retailers offering branded credit at checkout |

| End customers | Smoother UX; more tailored products | Instant checking accounts, one-click credit |

There are trade-offs. Opening the bank stack to external developers raises compliance complexity, adds new operational risks, and forces banks to rethink old guard processes. But those are manageable when the value equation is strong: partners bring scale and novel distribution, and banks bring regulatory cover and balance sheet strength.

Designing trust in a distributed world

Trust is the currency here. Customers may not care which balance sheet is behind a payment — but they do care that their money is safe, fees are transparent, and disputes are resolved quickly. That’s why successful platform strategies pair slick developer experiences with ironclad risk, fraud, and compliance controls behind the scenes. In short: speed without safety is a dead end.

Another ingredient is interoperability. When standards and open APIs flourish, smaller players can plug into multiple providers and avoid vendor lock-in. That competition improves pricing and UX for consumers, and encourages banks to keep innovating.

What this means for the future

Expect more horizontal services — identity verification, ESG-linked deposits, modular lending — and deeper vertical integrations (healthcare fintech, gig-economy payroll solutions, travel-industry wallets). For consumers, the obvious upside is convenience: financial services that bend to real life instead of forcing you to bend to them.

But the shift also raises questions about economic inclusion and oversight. As financial services embed into everyday apps, regulators will need to ensure consumer protections travel with the product — regardless of which logo appears at checkout. That will be a core policy debate in the years ahead.

For now, the simple takeaway is this: banks becoming platforms is less about banks learning to code and more about the financial stack becoming programmable — and that programmability opens space for better, faster, and more personal money experiences. If you run a business, or simply love banking that behaves like a modern utility, this change is good news. It means smarter services, more choice, and financial tools that finally meet users where they already live.